Table of Contents

Architecture market analysis: Denmark, Germany, Austria, and Switzerland

Where do architectural firms find their potential customers, how do they meet, and what does the architecture market look like in these places?

For countless decades, architecture firms have been dependent on word-of-mouth tactics. With evolving markets and new technology emerging, architects’ approaches to image-building have changed, in addition to the way architects acquire new leads.

This question is very important for ArchitectureQuote (AQ), trying to shake things up and offer new means of generating leads for architects.

ArchitectureQuote is a platform that brings these two parties together.

This report aims to uncover and disseminate research to small-to-medium size architecture firms based in Denmark, Switzerland, Germany, and Austria – and their potential customers.

This research also aims to illustrate how a platform like ArchitectureQuote can bring new opportunities for architecture firms in different markets.

Scope of this research

This project will stay within the confines of a purely research-based report.

The research is split into the following sections:

- An extensive secondary research report looking at architecture market development

- A primary research report conducted using public questionnaires and face-to-face interviews with architects

The project was conducted over a six-week period during the year 2020.

Executive Summary of Architecture Market Research 2020

Germany is the go-to market for architects

This report finds that out of all the DACH countries (Germany, Austria, and Switzerland), Germany is by far the largest and most dominant market for architecture.

Germany has the most architects in employment, and the market size eclipses the other smaller nations.

For platforms like ArchitectureQuote, this presents a great opportunity to work with many architects and benefit from the industry-wide use of word-of-mouth for spreading platforms.

The other researched countries also present lucrative opportunities, but just not on the same scale as the German market.

Word-of-mouth remains important for architecture companies

Intensive primary research via face-to-face interviews with architects was conducted. This research shows that the primary way through which architecture companies get their leads is via word-of-mouth and referral.

Therefore, platforms like ArchitectureQuote should be wise to not dismiss this fact of the industry not being up to speed with the digital times. Word-of-mouth tactics in the architecture industry is considered a very important part of the process.

In addition to this research, a questionnaire was asked. Answers gave some useful insight, showing that most people within the architecture industry value the concept of ArchitectureQuote.

Respondents also mentioned that they would expect a platform to provide everything that they ask for, and not fulfilling

it would be a disappointment.

Urban construction and renovation gaining popularity

Finally, our research showed that amongst the respondents, the most popular type of project was new construction or renovation in an urban or suburban area.

Architecture Market Research

Denmark

The Danish building and construction industries are thriving. Investor confidence is high, and profits are healthy, but bids are in short supply in this architecture market.

The largest Danish building companies are eager for more international companies to participate in tenders for major building projects.

Foreign players with special competencies and innovative, efficient building methods are particularly welcome and stand an excellent chance of winning business.

The two visions of the architectural policy are to create good settings for life and growth.

In order to promote the government’s two visions for Danish architecture, the architectural policy focuses on ten target areas.

Ten Target Areas to Promote Danish architecture

- Greater architectural quality in public construction and development

- Promoting private demand for architectural quality

- Architectural quality and efficient construction must go hand-in-hand

- Innovative architecture must create healthy, accessible and sustainable

buildings - Greater architectural quality in subsidized housing

- High priority on architectural quality in planning

- The architectural heritage must be maintained and developed

- Better conditions for exports of Danish architecture

- Danish architecture must have a strong growth layer

- Danish architectural studies must be among the best in the world

The architectural policy describes challenges, goals, and initiatives for each of the ten areas.

In the coming years, the government will work to realize the two visions through a series of initiatives within the ten target areas.

The study here gives even deeper insight: The Architectural Profession in Europe

Residential Construction in Denamark

We researched Residential Construction (not adjusted for delays) by builders, region, phase of construction, use, and time. From this we can deduce that:

- Residential construction permits, starts, and under construction, all fell in 2018

- Residential construction permits fell by 14.6% year-over-year to just 22,619 units in 2018, following a decline of 15.8% in 2017, according to Statistics Denmark

- Stats plunged by 34.5% year-over-year to 14,997 units in 2018, after falling by 19% in the prior year.

- Dwellings under construction plunged by almost 40% to 18,963 units in 2018 from a year earlier, worse than the previous year’s 4.9% drop

- Completions rose by 12.4% year-over-year to 27,566 units in 2018, following a 16.1% growth in 2017

The Danish Architecture Market

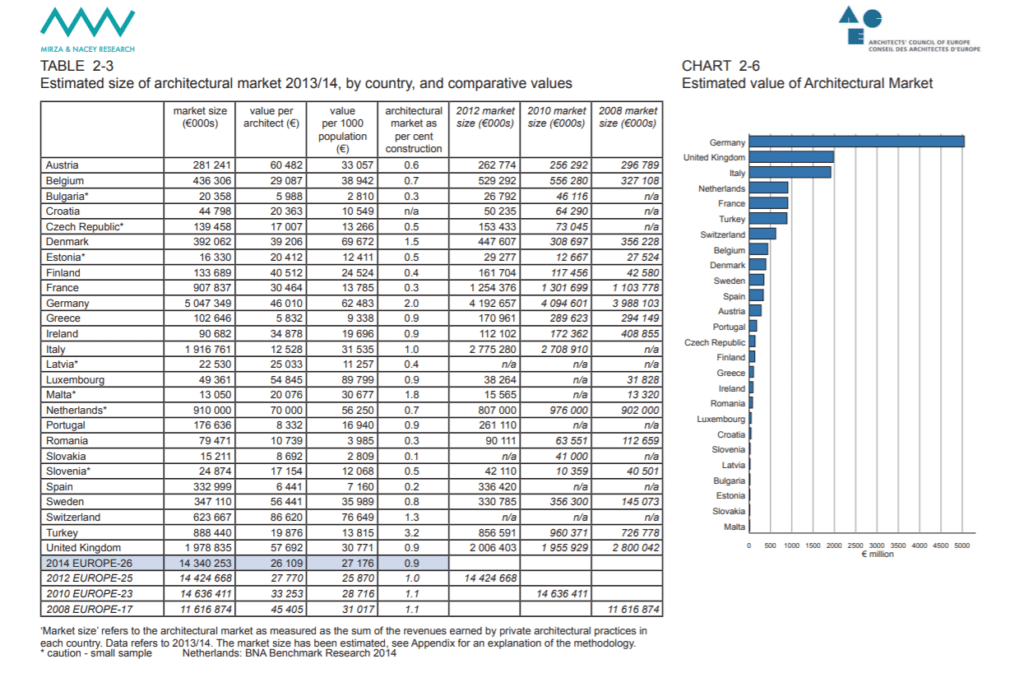

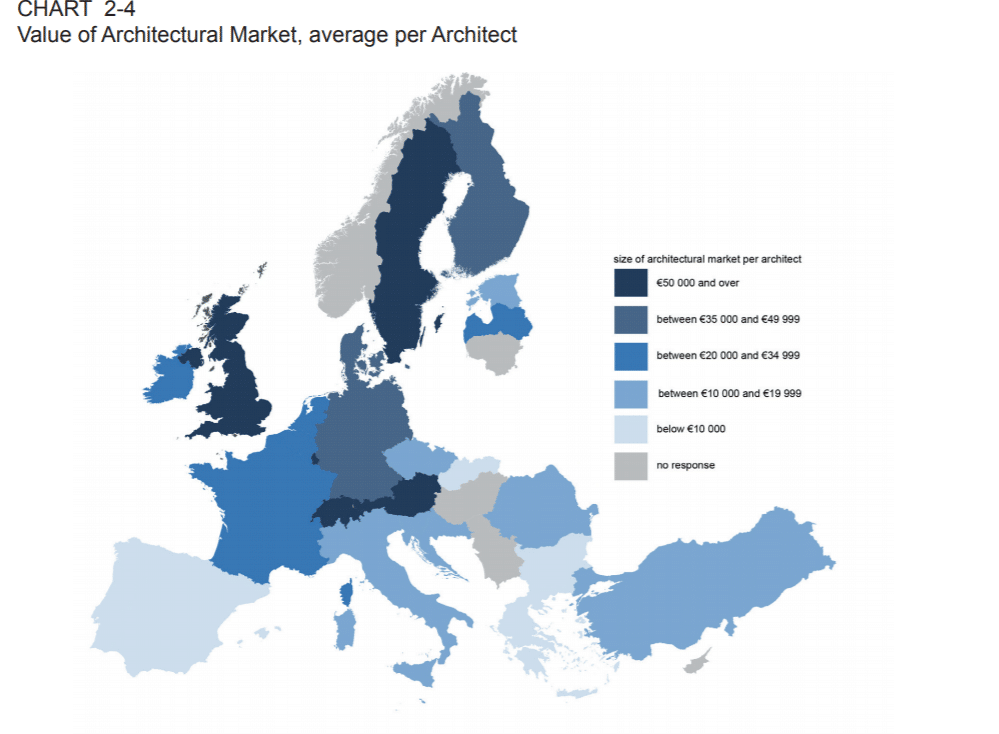

The chart above shows the value of the architectural market as the size of the market per architect. Denmark is ranked between €35.000 and €49.000, which is second to highest when you look at the overall chart.

We can, therefore, conclude that the Danish architecture market has a high overall value compared to most of

Europe. Yet, attention needs to be given to the countries ranking above Denmark in the chart below (chart 2-6).

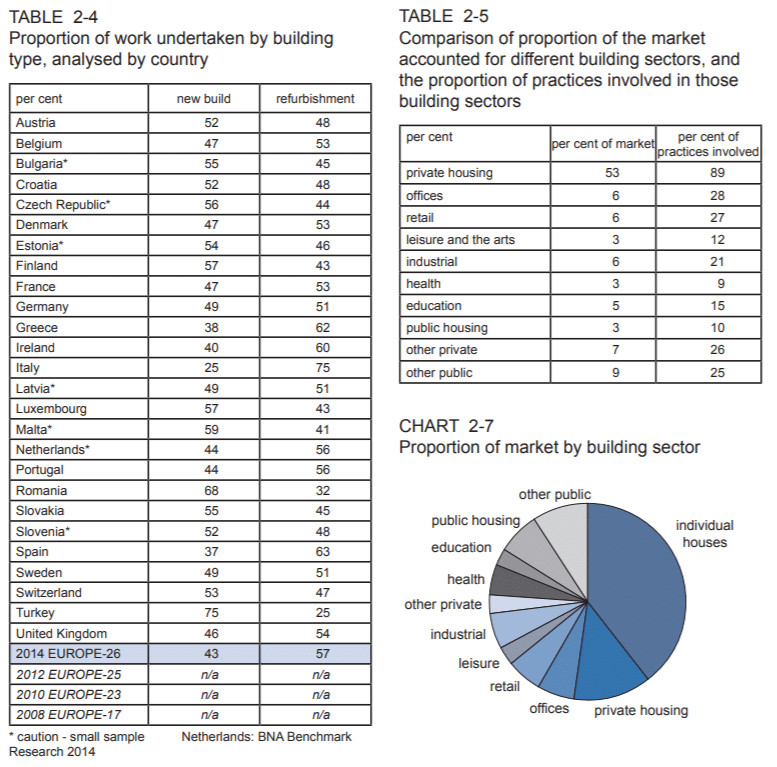

Table 2-4 shows the proportion of work undertaken by building type, analyzed by country. In Denmark, 43% of the work was a new build and 53% was rebuild/refurbished.

This means that the majority of construction was not newly built houses or buildings, but in fact, older buildings that have been updated or improved.

Danish architecture market, Macroeconomic indicators

Population:

The current population in Denmark is 5 792 318. It’s projected that the growth will decrease from 0.38% to 0.19% by 2050.

Denmark had an estimated population of 5.707 million in the year 2016 and expected to reach 5.974 million by 2022.

In February of 2020, the unemployment rate in Denmark was the same as the 13 months prior: 3.7%, approximately 103,923 people.

GDP per capita and GDP growth in Denamark

The growth rate in Denmark’s second quarter was 0.9%, which could be due to the increase in exports. This could result in an increase in inflation, thereby potentially affecting the country’s GDP.

Political Factors affecting Danish market

Denmark’s governance system is admirable, which is reflected in its high rankings in the World Bank’s Governance Indicators.

Both center-right and center-left governments have pursued broadly similar policies since 2001, leading to stability in terms of policy formulation and implementation.

In the 2019 general elections, the red block coalition emerged victoriously and the leader of the Social Democrat Party Mette Frederiksen became the prime minister of Denmark in June 2019.

The coalition secured 91 out of 179 seats in parliament and a minority government was formed.

Economic Factors affecting Danish market

Fiscal policy is at the center of Denmark’s economic activity with regard to regulating inflation. Monetary policy, meanwhile, seeks to boost the exchange rate. This guarantees a strong exchange rate for the Danish krone.

Denmark boasts an incredibly stable economic environment, making it all the more profitable for businesses investing in Danish companies. Not only is the general economic climate strong, but Denmark also ranks highly with regard to labor costs and taxation rates.

Investors in Denmark are offered a number of important tax advantages. Companies in Denmark also benefit from favorable rules on depreciation.

Denmark offers competitive labor costs when both wages and non-wages are taken into consideration, mainly because of the employer’s low-cost burden in terms of social security, labor taxes, etc.

Competitive labor costs and high productivity levels combine to make Denmark’s workforce one of the most efficient in Europe.

Sociological Factors affecting Danish market

A cornerstone in the Danish welfare system, also known as the Scandinavian welfare model, are free and equal rights to benefits such as healthcare and education for all citizens.

The strong welfare state ensures economic equality in society and virtually no corruption, with studies consistently showing that the Danes are among the happiest people on the planet.

Factors affecting Danish market Technological

Denmark also takes the lead in the use of digital technologies by businesses. More and more businesses have taken up cloud computing, eInvoicing (electronic invoicing) and social media

Furthermore, eCommerce sales by small and medium-sized enterprises are high.

Denmark provides a fast broadband (NG) cover and take-up of fast connections is also continuously increasing well above average European levels.

Austrian market for architects

Political Factors affecting the Austrian market

In 2018, Austria ranked as the 13th least fragile state in terms of politics and economy.

Furthermore, with regard to architecture and construction, the Austrian government published the Austrian Federal Guidelines for Building Culture – with clear information in both English and German.

The Federal Guidelines promote the governmental intentions in the architecture market, including strengthening competition, ensuring a focus on sustainability, and improving networks in the field.

Platforms like ArchitectureQuote view this positive growth of governmental policies in Austria as an opportunity.

In the ‘Third Austrian Building Culture Report – English Summary’, it is stated that additional guidelines will be implemented and linked to the existing policies. These five additional focuses are:

- Raise awareness of building culture and promote structures

- Strengthen the common good

- Plan holistically, innovatively, and to last

- Use land and other resources judiciously

- Link public funding to quality criteria

All five guidelines are in favor of ArchietctureQuote’s initiatives and will provide the company with the necessary environment to grow with national customers and providers.

Overall, from a political and legal perspective, Austria is enabling ArchietctureQuote to establish its position in the market.

When it comes to acquiring permits in Austria, due to the project of Big Energy Data (running from 2013), the time for acquiring the right building permit has drastically shortened.

Due to this project, the process for applying for a permit can take only a few hours. Furthermore, as Austria is a part of the OECD countries, the average processing time is around 2 to 12 weeks, depending on the specifics of the construction.

In addition, in the second quarter of 2019, the Austrian government approved around 27.600 building permits – the fourth-highest result since 2010.

Macroeconomic Indicators (Economical Factors) in Austrian market

To consider Austria as a country for the expansion of ArchietctureQuote, macroeconomic indicators and the current and forecasted state of the market have to be considered.

The GDP Annual Growth rate lowering to 1.5% after last year’s 2% indicates only a small reduction in economic activities in Austria.

However, the GDP per capita remains high and growing, which secures a good environment for platforms like ArchietctureQuote operations – thanks to the economic production value attributed to an individual.

With low inflation rates, the interest rate of 0% follows, which leads to a very low nominal interest rate for both individuals and companies.

This interest rate will vary for each project; however, in comparison to countries with higher interest rates, it will

be more profitable in Austria. Therefore, Austria can expect higher frequency and quantity of borrowing money.

The low-interest rate is highly relevant and very positive for ArchitectureQuote, as their services, in the majority of cases, requires large amounts of capital, received via loans.

The housing indicators of Austria have positively risen since the last year in all aspects, which will further support the market and industry of architecture.

The steady rise in home ownership and construction output provide relevant information for ‘residential’ and ‘renovation’ projects made via Architecture Quote.

Social Factors affecting Austrian market

As a nation, Austria is very keen on its architecture. This can be seen through its official and largest website, wherein there is heavy emphasis on the architectural element. Both classic and modern architectural highlights of the country are promoted.

Design boom, a popular magazine with a focus on architecture and design, has a constant flow of information regarding the Austrian architectural news.

The amount and variety of articles and projects indicate both general popularity, but also indicate the abundance of financial resources held in the country.

Technological Factors affecting Austrian market

The great influence of technological factors can be perceived globally as Austria continues to focus on interconnection within the architectural field to share and gain knowledge.

Related article: “100 Best Architecture Firms in the Word (2020 Update)”

Market and Industry Analysis: Architecture in Austria

In Austria, there is a distinction made between architects and civil engineers, and they are commonly referred to separately.

Austrian Architects

The entire building construction, the design of interiors, as well as urban development and spatial planning, belong to the comprehensive field of activity of the architects.

Architects find contemporary architectural and urbanistic answers to the design tasks set by society, whereby they are committed to the demands of architects.

Austrian Civil engineers

The wide range of services offered by engineering consultants includes specialized technical planning through to the overall planning of complex investment projects. This includes competent testing and consulting services as neutral trustees of the client.

Through their innovative solutions, engineering consultants guarantee the quality of life for people in many areas of everyday life.

Austrian Architectural Market

In Austria, the value of the architectural market average per architect is relatively high compared to other European countries, even if we compare data to Germany or France.

The total amount of value estimated by country (see below) is a better representation of the quantity of finance and activity in the architectural field. Austria ranked only as number 12, meaning it does not hold a large value compared to other countries chosen for ArchitectureQuote (such as Germany, Switzerland, and Denmark).

Nevertheless, due to the high interest and financial resources of the Austrian architecture market, Austria remains an exciting opportunity. Companies like ArchitectureQuote can expect a smaller, but very valuable, presence.

When specific categories/sectors of architecture are considered, it should be acknowledged that 52% of the Austrian architectural projects are new builds and 48% are refurbishments.

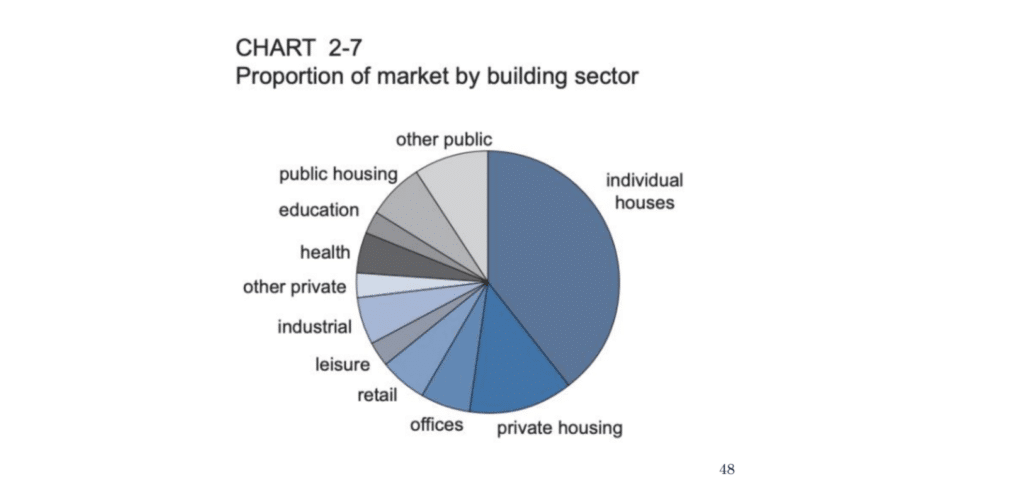

53% of the market consists of private housing, with any other sector lagging far behind, including industrial, health, public, and business buildings take account only for 3-9% of the architecture market.

Primary focus for companies looking to expand their business operation in Austria should be on private housing.

In the search for potential customers, we can look at the work undertaken by architects in Austria for different clients.

From these potential customers, individuals account for 46%. As this is the largest group, it must be taken into account, even though these projects generally generate less profit than projects of companies, developers and governments.

Limited companies make up 16% of architectural work undertaken in Austria, followed by the central government with 11%.

Austrian Cities

In order to locate the best environment to provide and market services like ArchitectureQuote, multiple criteria have been considered.

Population size was chosen as the most important criteria due to its direct connection with the architecture/building market.

Vienna, as the capital and most populated city, with nearly 1.6 million inhabitants, should be considered the focal point.

Following Vienna are other heavily populated cities such as Graz, which also houses the House of Architecture, Linz, Salzburg, and Innsbruck – all of which reach 100000 to 200000 inhabitants and provide potential customers an inviting environment, including architects.

Competitors, Similar platforms To ArchitectureQuote in Austria

Similar Platforms to AQ in Austria include Austria-Architects and the global Archello.

Austria-Architects

Austria-Architects is a platform oriented not only towards business, but also towards the general promotion of architectural work and the cultural aspect of the architecture field.

Members of Austria-Architects do not pay for searching and working within the platform. As a result of free usage of the platform, both parties are not provided with any other extra services.

Austria-Architects is often used only as a source of information and updates on the architecture market in Austria.

Archello

Archello is a globally operating platform. With regard to terms of services and inner workings, it is very similar to ArchitectureQuote. Archello, as with ArchitectureQuote, have no membership fees, which unfortunately isn’t directly known.

Since its establishment in 2013, Archello has since gained a vast number of users around the world. Notably, Germany has been one of the countries that have been the most searched and bring large numbers of projects.

German Architectural Market

Macroeconomic indicators

Population

The population of Germany is 83 786 388. Population growth is only approximately 0.3%. In 2050, it is projected that the population is going to fall below 80 million.

In terms of the growth rate of Germany, there was a -0.1% fall in their second quarter of 2019 and 0.4% annual growth. Their export activities are slowing down due to China and the US trade war, which results in a decrease in their growth as both countries have a high contribution to their export market.

Germany’s Gross National Product (GNP) increased by almost 20 billion euros throughout 2019, to almost 890 billion euros during the second quarter of 2019.

Germany : Housing Index

Construction input increased by 1.40% in August 2019. This is an important index that shows the overall construction work performed by enterprises whose principal activity is classified as construction.

The housing index shows the price index of housing sales, which is currently at an all-time high with 166.07 index points.

The building permits have decreased to 27365. Nevertheless, it is still close to the all-time high of 31125, which was hit in December 2016. It means that there are still large opportunities in the construction market.

Construction orders are increasing but decreased since the last year. Germans are still interested in owning homes since the home ownership rate is at 51.5%, even if it is really close to the record low reached in 2017 of 51.40%.

Germany is the second biggest nation per size of Construction Market in Europe during 2013, with an estimate of €250 billion in 2013 (Chart 2-1).

The value of the Architectural market on average per architect during 2014 is estimated to be between €35000 and €50000.

Individual houses are the biggest part of the architectural market (Chart 2-7).

German Architecture market

Over 80% of architects’ offices in Germany have 1-4 employees and only 8% of the offices in Germany have 10 and more.

Germany is, nonetheless, the country of big architectural companies, and the number of architects is high with around 107200 architects in 2014 .

The number of freelancers in Germany appears to be low, with most being private practice salaried, followed by the sole principal.

Germany also has a high percentage of Architects aged under 40. This is a good indication of opportunities, as young people are more willing to use lead platforms like ArchiotectureQuote.

Competitors For ArchitectureQuote in Germany

In Germany, we found two main competitors in the architecture market; Upwork and Freelance.

Upwork

Upwork is a website platform where they match professionals and agencies to businesses seeking specialized talents, including architects. The cost for the professional changes based on their expertise in the area and percentage of job success.

Freelance

Freelance works in the exact same way as Upwork. You can find professionals that will help you with your projects.

Political Factors in German Market

Germany is a Federal, Parliamentary Democratic Republic, with the Chancellor as head of the government.

Germany has recently been rankled by political turmoil. Imminent changes in leadership, together with the looming shadow of Brexit, have caused a fair amount of upheaval in the political landscape of the country.

Economic Factors in German Market

Germany is the 4th largest economy in the world. With 2019 nominal GDP forecasts set to the tune of $4.2 trillion, the country looks set for robust economic growth.

However, a GDP decline in late 2018 showed the worst quarter in several years. Despite this, Germany boasts a low unemployment rate of 3.2%, which is arguably one of the lowest worldwide.

As one of the top exporters in the world, Germany has a mixed economy with a budget surplus. And although the recent refugee crisis has left the country shaken, Germany looks set to remain an established economic power with a strong economic foundation.

Social Factors in German Market

Due to its high economic standards and educational and technological advancements, Germany is considered one of the best places to live on the planet. The life expectancy for German women is around 83.5 years, while for men it is 78.6 years.

The country has a modest birth rate, leading to a shrinking and largely elderly population. A cosmopolitan country with diverse lifestyles, the majority of the population here identifies as Christian, though Islam and other religions are also practiced.

Almost 21 million people in the country come from a background of immigration. Germany identifies itself as a welfare state and considers citizen welfare its primary objective.

Technological Factors in German Market

Germany is well known for its advancements in the field of science and technology. As one of the leading car manufacturers in the world, Germany is home to global automobile brands such as Mercedes, Volkswagen, and BMW.

Globally, Germany is considered the 5th most technologically advanced nation, with expertise across multiple sectors such as engineering, medicine, and infrastructure.

The country is also a leading nation in terms of information technology and has already made significant advances in the fields of AI and machine learning.

Switzerland, Market for architecture

Political Factors in the Swiss Market

Switzerland has three political systems established in the country. These federal, cantonal, and communal governments ensure equality, preventing one person from being the deciding factor with regard to decision-making.

The Swiss government consists of seven members with equal rights and power. This means that, nationally, Switzerland maintains a well-structured and balanced government system. However, internationally-speaking, since 2016, Switzerland is no longer a member of the EU.

The Swiss government aids economic support to the Hotels and Tourism sector in order to encourage further building and refurbishments, with the aim of increasing tourism activities in Switzerland.

Economic Factors in the Swiss Market

At the end of 2018, Switzerland’s GDP stood at 703 billion USD, with an average annual growth rate of 2.8%. This is in addition to impressively low unemployment rates at 2.6%. Switzerland has a very export-dominant economy.

The Swiss architecture market is considered to be amongst the topmost valuable markets per architect pay. The architecture industry has grown partly due to the influx of immigrants to the country.

Residential architecture now dominates the architecture market by making up 32.3% of the architecture industry in Switzerland.

Social Factors in Swiss Market

Switzerland has the second-highest quality of life in the world. Furthermore, with a very educated population, the Economist Intelligence Unit (EIU) ranked Switzerland the best place in the world to be born.

Switzerland has a relatively small country of only 8 million residents.

Despite the small population, Switzerland has 4 native official languages: German, French, Italian, and Romansh, although the Swiss dialect of German is the most commonly spoken language in the country.

Switzerland borders a high number of five countries: Germany, Austria, Liechtenstein, Italy, and France.

Technological Factors in Swiss Market

With rapid technological advancements in the country, 93% of households in Switzerland have access to the internet and 86% of the population use computers. Switzerland’s R&D industry is growing and constitutes 2.9% of the country’s GDP.

Switzerland has 46.3 fixed broadband connections per 100 inhabitants, which is the world’s second-highest score, just behind

Monaco.

It is a benefit that technology has such a primary role in the society of Switzerland because maintaining a technological edge in the world is important for the efficiency and lifestyle of any country.

Environmental Factors in the Swiss Market

31% of Switzerland is covered with forests and mountain ranges. Maintaining these levels of the environment is of utmost importance for the country to stand out in the Environmental Performance Index (EPI).

In Switzerland, 56% of the electricity that is generated comes from hydroelectricity, and 40% comes from nuclear power.

Switzerland ranks amongst the top globally with regard to recycling and sustainability levels, with an impressive 54% recycling rate.

The heat production within the residential building sector in Switzerland primarily comes from heating oil (44%), followed by natural gas (25%), and then electricity (18%).

In 2014, energy consumption from households was equivalent to 24% of the total Swiss emissions but has since been falling at an average annual rate of –3,45%.

The Swiss government has decided to pursue an energy policy that’s focused on energy efficiency and balancing the use of hydropower and renewable energy sources, so as to bring down CO2 emissions by 80-90% before 2050.

Legal Factors in the Swiss Market

The legal side of Switzerland is broken up into cantons (regions). Taxes vary depending on the canton wherein you are located, and the tax burden equals 29.8% of the total domestic income.

Switzerland is known for its great intellectual property rights and enforcement. Furthermore, Switzerland is known for being an Individualist society, focusing on self-growth. This helps growth within the country, across a plethora of sectors.

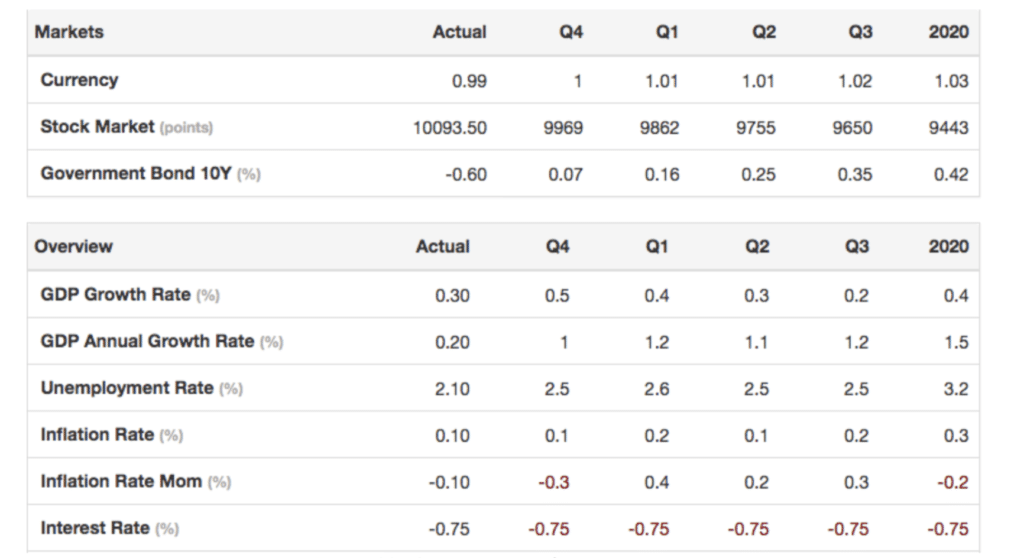

Macro-economic environment in Switzerland

Another important aspect is the interest rate, which rests at less than 0%, which means the Swiss banks will be able to give favorable interest rates to businesses and private consumers.

Swiss people and firms are, therefore, in a good situation to use/borrow money for building projects.

The Swiss market doesn’t seem to change drastically within the 4 quarters in the figure shown above, though the unemployment rate will rise to 3.2%, and the inflation rate will rise from 0.1% to 0.3% – which is still rather good.

The Market in Switzerland

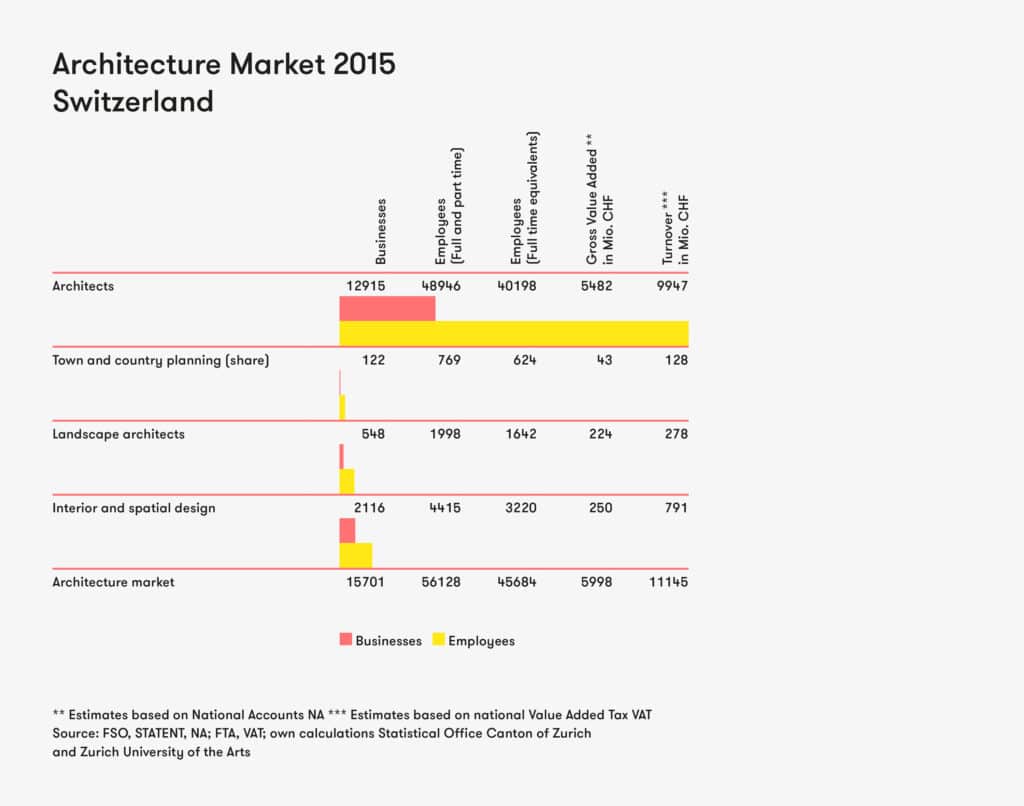

One of the largest aspects of the Swiss creative industry is the architecture market. This is shown by the fact that approximately 16 000 businesses employ more than 56 000 people, creating a turnover of 11 billion CHF.

The only sub-market exceeding the value of the architecture market in the creative industry is that of computer games and software.

The industry had positive growth in the period 2013-15, where businesses and employees grew by roughly 3%, gross added value grew by 8%, and turnover grew by 0.9%.

The steady growth within the Swiss market is credited to an array of factors, including, but not limited to, excellent architecture schools, strong building trade, and healthy competition allowing newer firms to get involved.

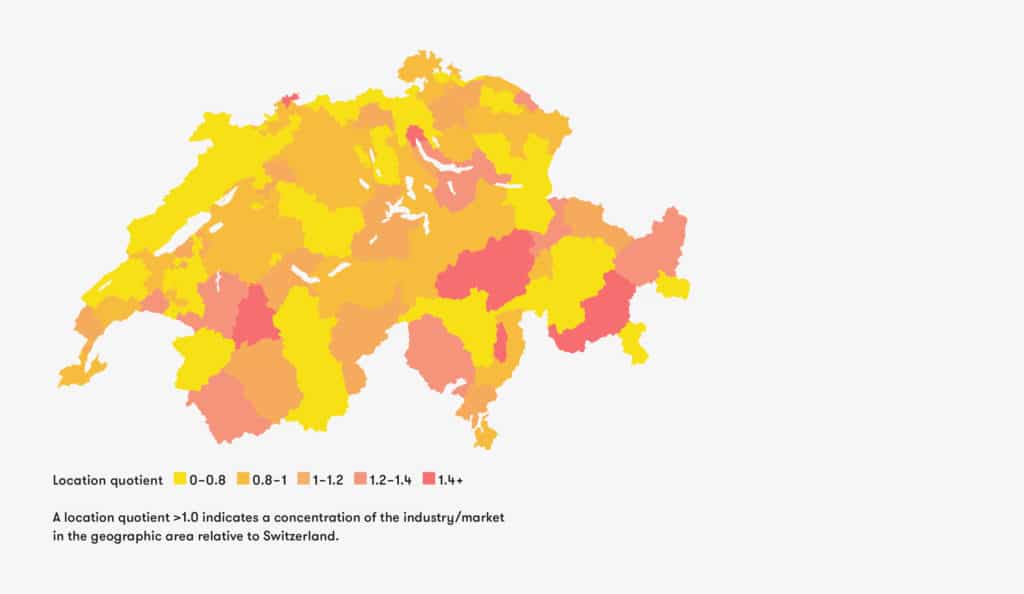

As the figure above shows, the main concentration of the industry is in the south-western and south-eastern borders of Switzerland.

The Swiss architecture market is distributed. The classical architectural firms dominate the industry by far in all aspects. The architect businesses employ between 3-4 full and part-time employees per firm.

As can be seen in the graph above, Switzerland is in the lower top of the construction markets in Europe, even though the Swiss population is at a mere 8.5 billion versus the >66 billion French population.

The graph above reveals that the Swiss architecture market is one of the most valuable European markets on average per architect. Only the United Kingdom, Luxembourg, Austria, and Sweden can compare to the same value.

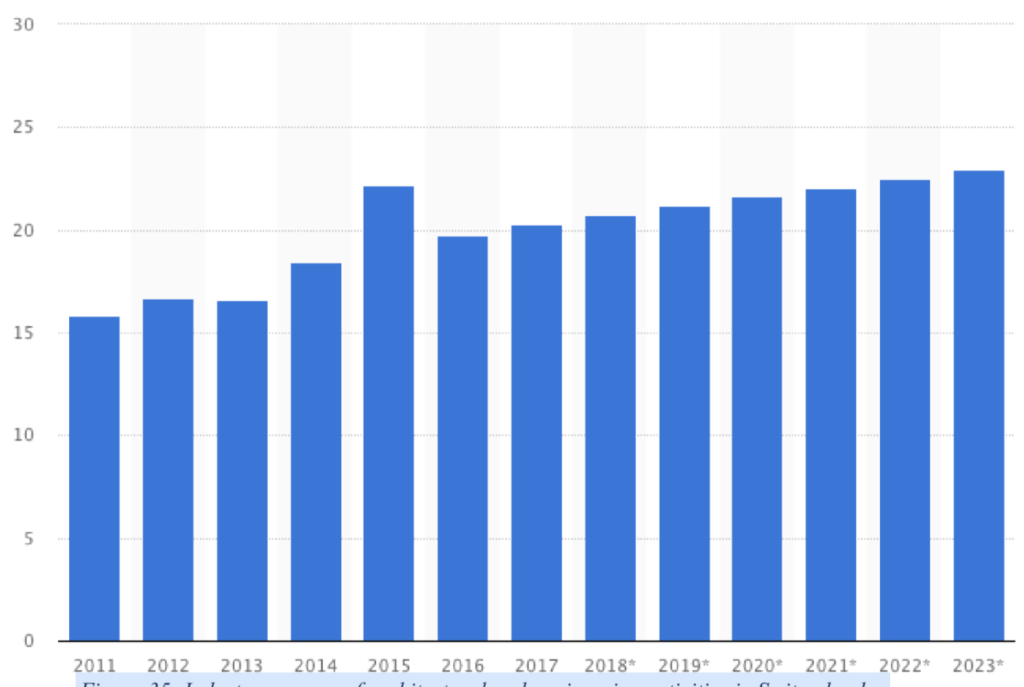

The table above reveals the market forecast that was set for 2018-23, after observing the market in the period 2011-2015. The market is projected to have a steady growth from a value of 20.29 billion USD in 2017 to 22.93 billion USD in 2023.

The Swiss government has taken initiatives to increase the tourism sector by focusing on developing the Swiss leisure and hospitality infrastructure. The Swiss government will, therefore, be supporting the hotel industry by providing financial assistance to construction and expansion of said hotel industry.

The residential construction market is expected to remain the largest segment with 32.3% of the total industry value in 2021. It is expected that this segment will grow so much until 2021 due to an influx of migration, which will drive the demand for new housing units.

The construction industry in Switzerland is furthermore expected to gain momentum due to better investor and consumer confidence that is credited to an improving economy.

It is forecast that there’ll be an acceleration of flow in investments to the Swiss construction projects between 2017-2021.

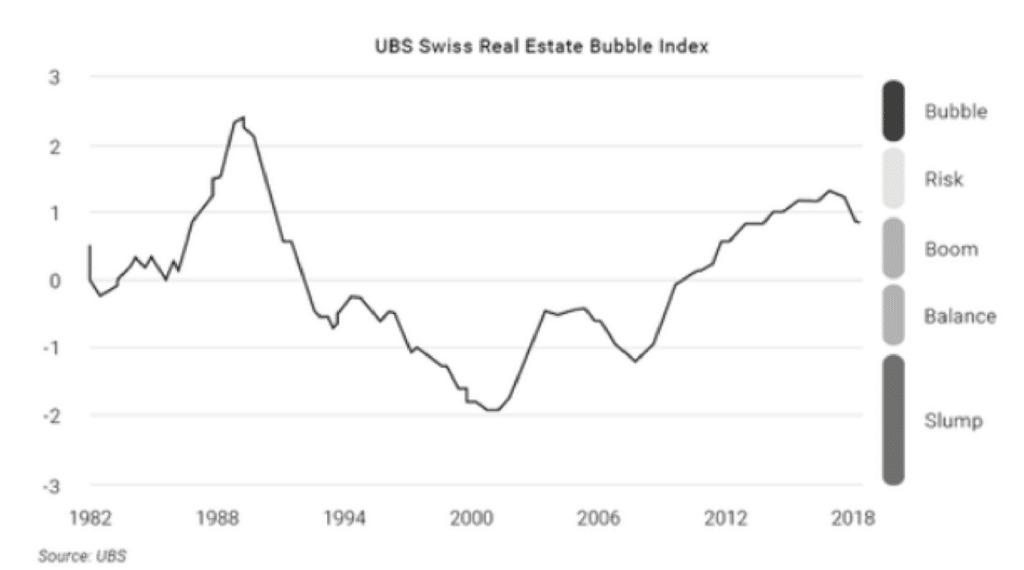

It’s worthwhile to note that, according to figure above, the Swiss real estate market is moving between booming and being at risk of a bubble. If the market is to create a bubble that would burst, the construction projects for real estate would plummet.

The table above explains how Swiss architecture is the most valuable per architect and the second most valuable per 1000 population after Luxembourg.

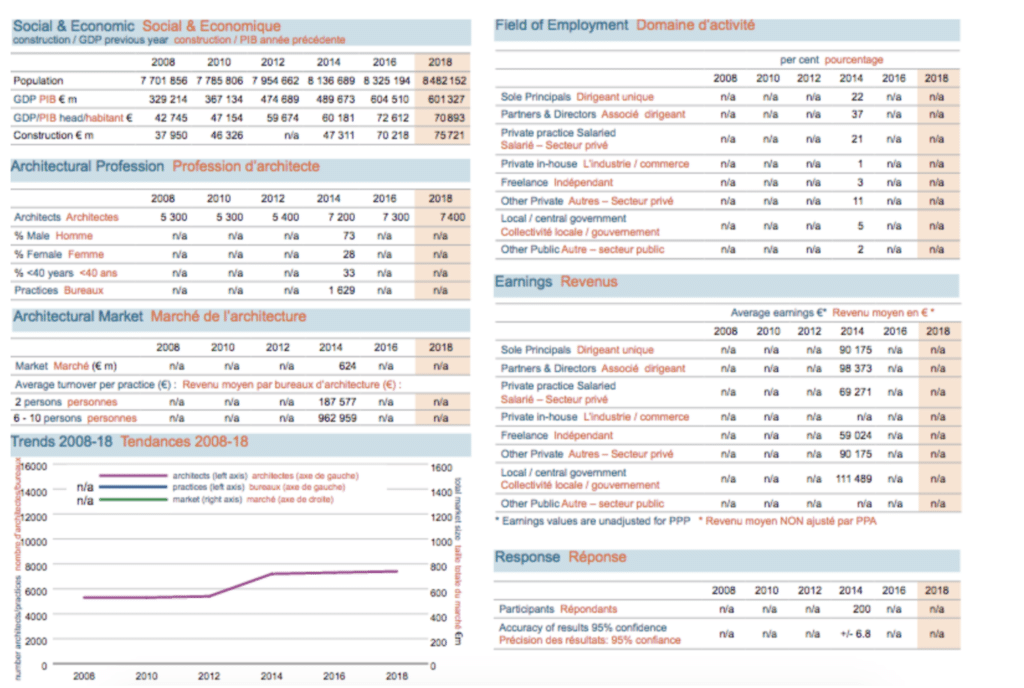

According to the Architects’ Council of Europe, the number of architects in Switzerland rose from 5300 to 7400 between 2008 and 2018, as shown in the figure above.

The architecture market seemingly consists of primarily male architects and only 33% of the architects are above 40 years old.

Projects with 2 persons give an average turnover of 187 577 € (2014), while projects with 6-10 persons give a turnover of 962 969 € (2014).

Swiss architects mostly work as sole principals or under partners & directors or private practice salaried, while freelancers only make up 3% of the total number of architects.

The earnings of the architects are primarily around the 90 000 €, while freelancers make just below 60 000 € on average.

Competitors for ArchitectureQuote in Switzerland

Platforms like ArchitectureQuote operating on the Swiss market are Swiss-architects, Architonic an Architektur-Schweiz.

Swiss-architects

Swiss-architects is an online platform offering space for digital architect portfolios. On this platform, architects, landscape architects, interior architects, etc. can create accounts to get access to an already established network of professionals, who seek to co-operate on projects.

The difference between Swiss-architects and AQ is that AQ offers a more cohesive platform for two-way communication. This means there is as much of a focus on architects contacting clients as there is on clients contacting architects – completely tailored to individual budgets.

Architonic

Architonic is another digital portfolio platform with a focus on interior design and the selection is, therefore, quite slim compared to AQ and Swiss-architects.

Architektur-Schweiz

Architektur-Schweiz is an online platform offering physical conferences and pop-up shows in Switzerland with more than 500 architect firms signed up with a focus on young and innovative architects.

The key difference between Architektur-Schweiz and AQ is that AQ offers digital portfolios of the architects and means of close contact between the architects and clients, while Architektur-Schweiz offers physical meetings between the two parts, whereby they themselves will facilitate the deal.

Architecture Billings Index (ABI)

The Architecture Billings Index is calculated once every quarter for the American architecture market for construction and explains the demands for design services on commercial, industrial, and mixed practice projects.

The ABI is an indicator which gives architects an insight into how the market will look like in just less than a year. If the ABI falls below 50, that means that there has been a decrease prior to the last month. The ABI has been falling in the USA for the last two years, and the latest ABI went to 47.289.

The ABI also calculates the regional proportions where recent reports from 2019 show that the West increased to 51.2, whilst decreases were seen in the Northeast (49.1), South (48.2) and Midwest (46.4).

Decreases or increases in the American markets often mean that there’ll be fluctuations in the global markets, therefore affecting Denmark and the DACH-countries.

Building Permits in Denmark and the DACH countries

The commune of Copenhagen:

Building permits for simple refurbishment will be given during the screening process, which is on average within 3-10 weeks.

To be more specific, permits take about:

- 40-60 days on average for family houses

- 55-80 days on average for multiple floors of business building

- 60-90 days on average for multiple floor’s residential building

City of Berlin, Germany

A building permit within the borders of Berlin can take anywhere between two weeks up to six months based on several factors that will have to be reviewed during the permit process.

Kanton (Region) of Zürich, Switzerland

The granting authorities in Zürich will usually be able to make the decision within 2 months for smaller projects and refurbishment, but the process will be stretched up to 4 months for larger new buildings and major refurbishments.

City of Vienna, Austria:

The Viennese authorities will be able to decide on whether to grant the builder his building permit 8 weeks after submission of the plans.

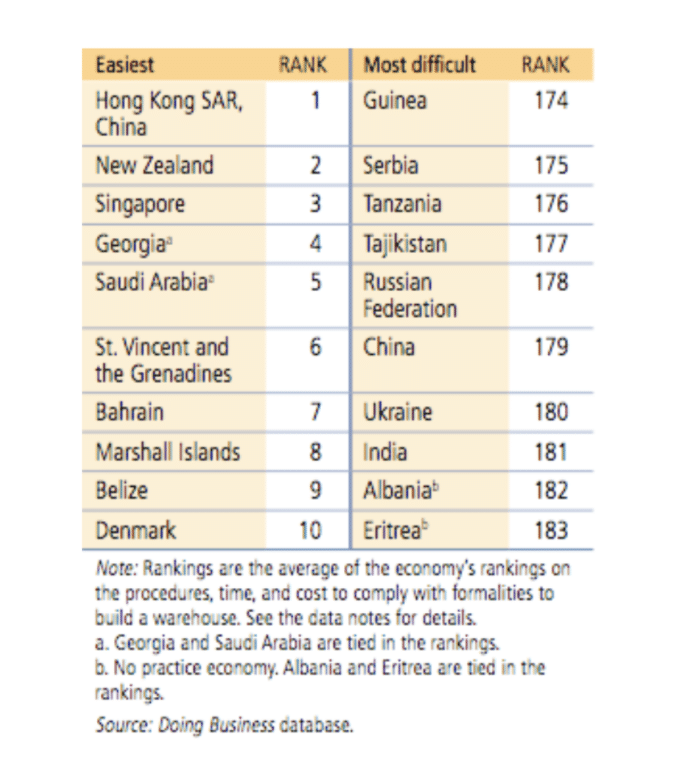

According to the figure above, Denmark is amongst the top 10 easiest countries in the world to deal with building permits. The process of obtaining a building permit in Denmark is expected to be quicker and less painful to deal with than in most other countries in the world.

Denmark has the fewest amount of procedures during the process of obtaining a construction permit, which lowers the chance of corruption and increases the motivation to construct buildings.

Related article: “80 Architecture Statistics (2020 Update)”

Consumer/customer Behavior

The Questionnaire

The questionnaire has been divided into three parts.

The first part of the questionnaire has been directed to customers that are planning to cooperate with architects in the future.

The second part was dedicated to people that have had previous experience working with architects. Acknowledging their personal experience in the questionnaire was essential to determine potential issues to avoid in the future for companies like ArchitectureQuote. This also gave insight about consumer expectations that AQ will need to face in the future.

The last part of the report was directed at people that have never had any personal experience with Architects’ Council of Europe.

The architectural profession in Europe

In total, 91 responses have been collected. Respondents were citizens from an array of countries in Europe, such as Denmark, Germany, the United Kingdom, and Sweden.

- Already hired an architect once: 25 respondents

- Considering hiring an architect: 26 respondents

- Not interested in hiring and never hired an architect: 40 respondents

The following graph presents the percentages of the three types of respondents.

1.1 WILLS

During the questionnaire, there are several questions that can result in a kind of persona. Due to the fact that 91 people gave a response to the questionnaire, this group can be separated into 3 groups, only 27 responses are analyzed in this part.

Those 27 respondents are from the group that stated they are considering hiring an architect.

1.1.1 Potential target group for ArchitectureQuote

There are a lot of people who could be interested in hiring an architect. This is useful for AQ to know because it is plausible that those in need of an architect might also be interested in a company that offers a service like AQ. It is, thus, important for AQ to analyze this group of people, in order to determine how to capture the attention of potential customers.

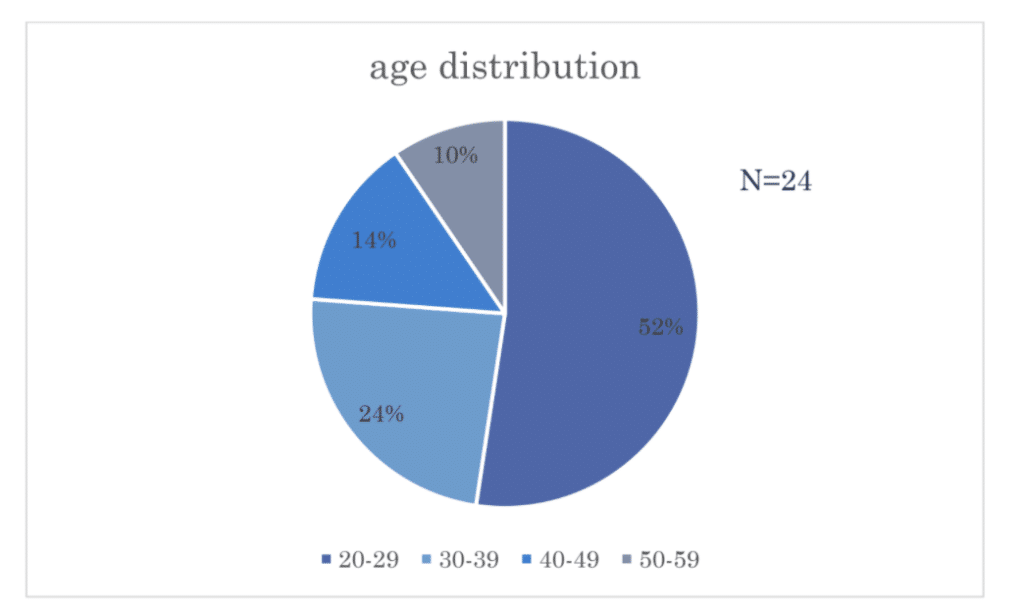

Age

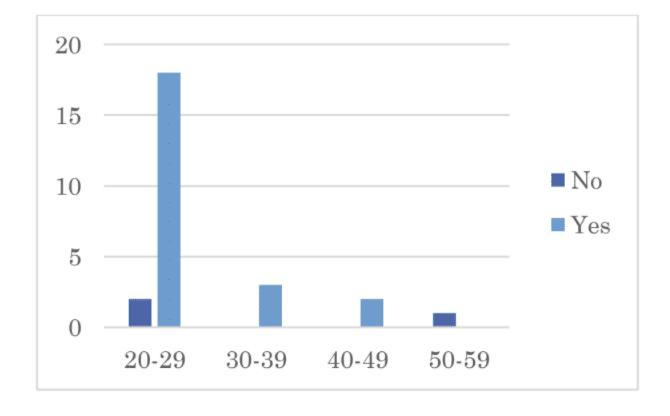

By correlating the age of respondents with potential interest in AQ, a more specific target group can be focused on by the company. The numbers on the vertical axis in the graph below represent the number of respondents.

The correlation between the person’s age and if they are interested in a company like AQ shows that most of the respondents between 20 and 29 are interested.

The consensus amongst the respondents was that there is an interest in a company which offers a service in finding the most suitable architect and helping them during the process of a new project.

Occupation & Country

The graph below shows the country where the respondents would like to build their project, correlated to the occupation of the respondent. By looking at the relationship between country and occupation, one can attempt to deduce what country ‘attracts’ which kind of occupations. The numbers on the vertical axis represent the number of respondents.

Most of the respondents who are interested in AQ would like to realize their project in Germany or Denmark. One can make the assumption that these people actually come from the countries they want to build their projects.

After looking at peoples’ occupations who are interested in AQ, it can be determined that most of them have a full-time job or are students.

This is especially true for the case of Germany – it is obvious that every respondent has full-time employment or is a student.

This makes these characteristics the most interesting ones for AQ to focus on, with regard to this questionnaire.

Finding an architect & country

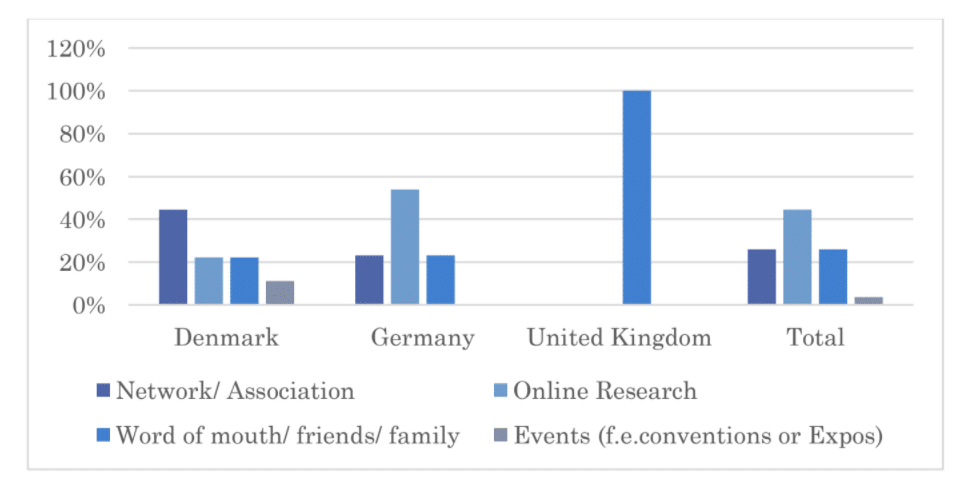

By assessing how people from different countries approach finding an architect, one can obtain information about how to reach potential target groups in different countries.

Norway, Switzerland, and Sweden have been discounted from the graph because there was only one respondent for each of these countries.

Correlation between finding an architect and country

Regarding the Danish architecture market, people will use their network (for example an acquaintance) the most. A possible way for AQ to expand their network is by going to fairs and getting in touch with new people and companies.

Overall, when looking at both the German and Danish architecture market, word-of-mouth/friends and family is a popular medium. The most popular amongst the German respondents is finding the most suitable architect with online research.

This means that AQ, for example, should heavily utilize Search Engine Optimization (SEO) to ensure that it is ranking highly in searches. This increases the chances of listing as one of the first options for potential customers that are searching for certain keywords.

1.1.2 Project related

In order for the analysis to be more specific for AQ, we set a filter for several questions in order to only take into account the answers from the respondents that would be interested in the platform.

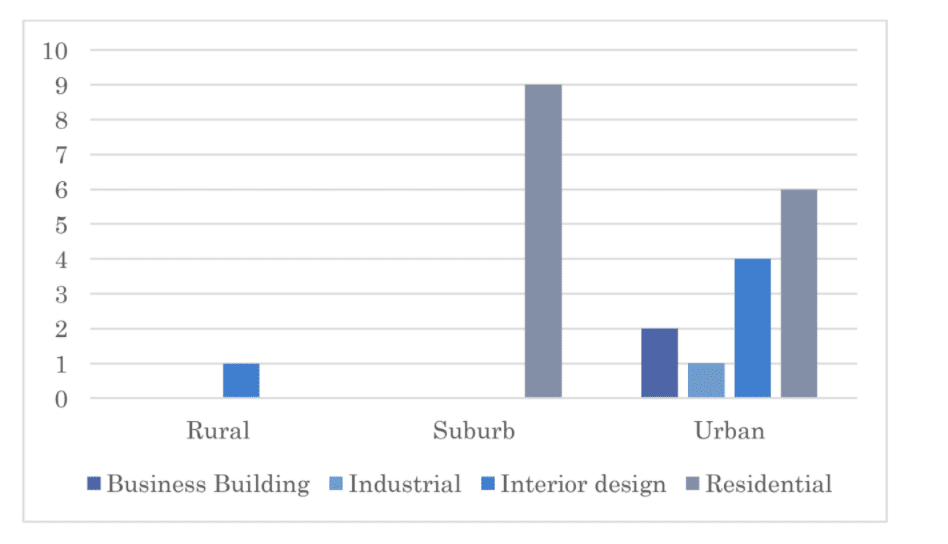

- The first graph shows (for those that are interested in AQ) the correlation between what type of project there is interest in with the type of building of interest

- This second graph shows the most popular types of projects amongst different age groups

An important observation is that all the answers focus on four types of projects out of seven: residential, interior design, business building, and industrial.

The other three – healthcare, academic, and landscape – weren’t considered in the analysis since none of the responses mentioned them.

Consequently, it is more interesting for AQ to invest resources into these areas, making them a priority. Since most respondents are between 20 and 29 years old, most of them are interested in new residential construction.

Due to the fact that it will most probably be their first architectural project, AQ can be helpful in terms of facilitating the process. Several people would also be interested in renovating the interior design of their current building.

Filtered so as to just look at those interested in AQ, the graph below looks at the relationship between the areas the respondents would be interested pursuing projects with the type of project itself.

For those respondents interested in AQ, the most appealing area for all types of project is urban. In terms of residential projects, the most desired areas are suburb and urban.

Taking all of this into consideration, across all categories, the most interesting projects for AQ to focus on are those focused on residential developments and interior design.

Respondents were asked to answer from a personal point of view and not so much as a company, which would explain the more intense interest in residential projects, as opposed to industrial.

The potential budget of the client and the size of the project required

Most of the people from the survey are willing to spend up to 100 000€ for their project. The most popular demand is a project of under 200m2 with a potential budge of 100 000€.

Some clients, however, would be willing to spend up to 500 000€ for a 200m2 construction project, thus requiring more design and technical features.

Higher interest in less than 200m2 projects can also be explained by the fact that most respondents would realize the project in an urban area with space limits.

The respondents interested in a project smaller than 100m2 are mostly looking for cost-effectiveness, while those interested in 100-200m2 are ready to spend up to 500 000€. This could also imply that they want to be more personally invested in the project.

The most popular type of project among all age categories is residential.

The second most popular type of project, that the youngest category is interested in is interior design.

Since most respondents are interested in a smaller scale project (less than 200m2), AQ should focus on inviting more independent architects to the platform in order to be able to provide a sufficient amount of project proposals in this category.

1.1.3. Potential Services of ArchitectureQuote

Some questions in the questionnaire are related to services. This is interesting for AQ to take into account, ensuring this platform and its architects can offer the most desired kinds of services.

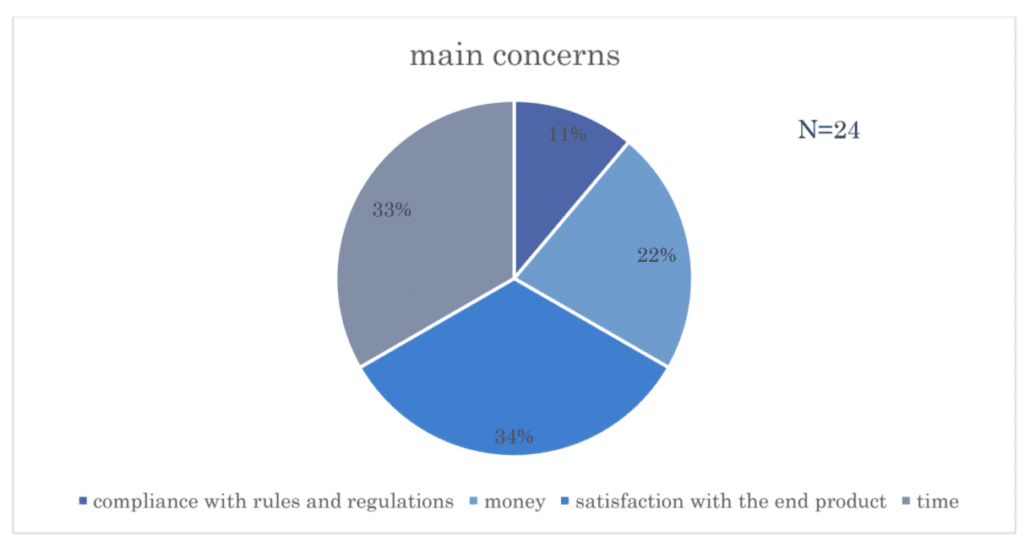

Project & concerns

For AQ, it is interesting to know the potential client’s concerns for each type of project. As a result, AQ can optimize the services that they offer.

The respondents were able to choose more than one option because a potential client can have more than one concern during the building process.

The numbers on the vertical axis represents the number of respondents.

The most concerns relate to the residential type of project. This is intuitive because of the fact that most respondents expressed most interest in this type of project.

Regarding specific possible concerns, time and money are the most popular ones among the respondents.

Satisfaction with the end product is also another factor that causes concerns. Because of this, it’s really important for AQ and its architects to have enough contact with their clients and keep them updated during the process.

This service could also act as a precautionary device for concerns regarding money and time.

Project & Expectations

AQ needs to know what potential clients expect from architects. The next graph shows the expectations for each kind of project.

The numbers on the vertical axis represent the number of respondents.

As shown in the ‘project’ part of the analysis, most of the respondents are interested in new construction and renovations. For both scenarios, the respondents expect all kinds of tasks to be completed by the architects they can choose on the website of AQ.

Even knowing the expectations of an architect, it’s still important to have enough contact between the architect and the client. This is due to the fact, that some respondents expect only one type of task to be completed by the architects, whereas others expect more, or least different types, of tasks.

For example, one of the respondents expects concept design, schematic design, detailed design, and tender from an architect.

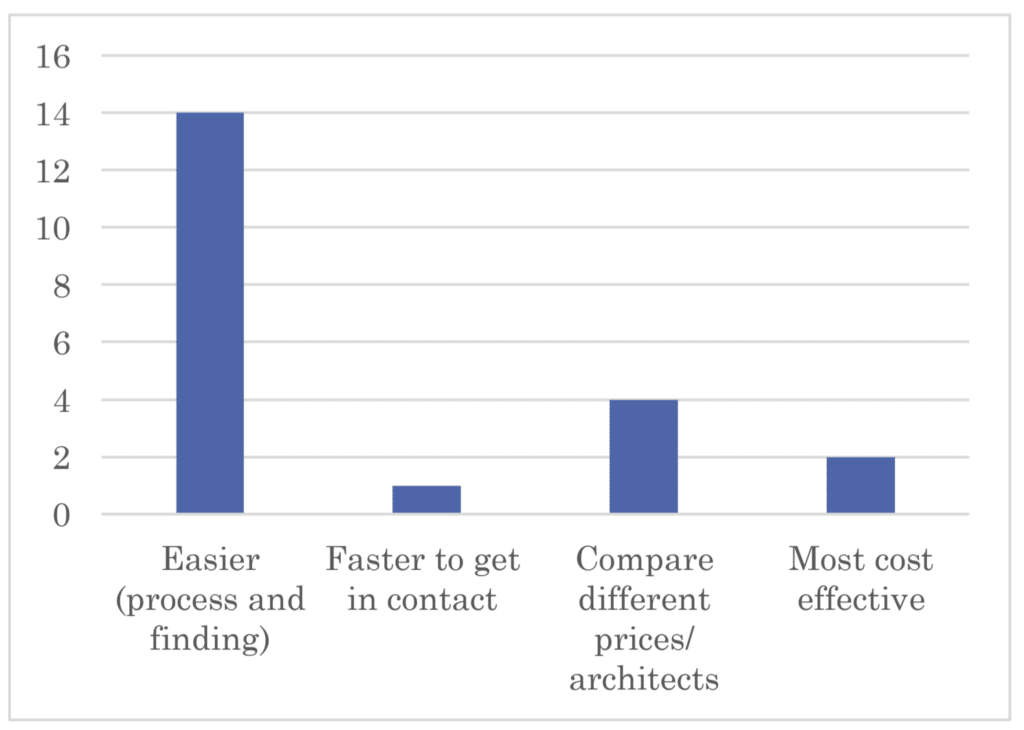

Reasons for being interested in AQ’s platform

The last question in the questionnaire concerns the reason for being interested in AQ. Respondents gave similar kinds of answers, but phrased in a plethora of ways.

By summarizing those answers, it’s easier to divide the different reasons. The numbers on the vertical axis represent the number of respondents.

The most popular reason is that potential clients expect AQ’s services to make the process of finding the best architect easier.

As a result, customers expect this – namely, easier contact points and smoother processes – from AQ and their services. Potential clients also think using AQ would help in the process of comparing different prices and architects.

This gives AQ the incentive to consider thoroughly developing this service of offering potential customers price comparisons and portfolio comparisons of architects.

2.1 HAVES

The second part of the questionnaire was aimed at people who have already worked with an architect in the past. In total, there were 24 persons who stated to have done so.

In addition to general questions about the realized project, such as size, type, and budget, the questionnaire deals with problems and concerns that arose during the search and the actual work with an architect.

Together with advice from respondents themselves, and their opinion on whether they would work with architects again, AQ can target specific areas for improvements for its services. This will be explained in the following section, using the results of the questionnaire.

Of those who had already employed an architect in the past, 52% were between 20 and 29 years old at that time. From the responses of the 24 people surveyed, the number of people who had worked with an architect in the past decreases with age.

This means the majority of respondents from this questionnaire were already seeking, and working with, an architect at a young age.

Nevertheless, it must be acknowledged that the survey was conducted by students and, therefore, mainly circulated around this kind of network, making the average age of respondents lower than, perhaps, reality.

In order to get a more precise idea of the people who engaged in the questionnaire, the correlation between occupation and age is here analyzed. It is striking that 26.4% of the age group 20 to 29 years old is already full-time working, and another 26.4% are self-employed.

The remaining 27.3% of 20-29-year olds are still studying. It should also be noted that 62.0% of those surveyed were already employed full-time during the period within which they were working with an architect.

While the majority of the projects (62%) were located in Denmark, 23% (5 projects) were realized in Germany.

The graph above illustrates the means through which the different age groups found their respective architects. This give AQ a rough idea of how each age group can be targeted most effectively, and also which means is the best to focus resources on.

Results show that word of mouth played an important role among the 30 to 49-year old category, but was especially common among 20 to 29 year-olds.

It should be noted that the age provided in the graph refers to the age at the time of the collaboration with the architect, not their current age. This is crucial to point out because the means of finding an architect today may have changed, considering a 40 year-old who worked with an architect 15 years ago may have been less likely to rely on the internet.

It is also worth noting that online research in this questionnaire was exclusively used by the 30 to 39 year-olds.

The diagram above shows whether a new building, a renovation, or a structural modification was carried out for each type of project area. This shows AQ what kind of project type has been most common amongst the respondents.

A total of 79.2% of the projects were executed in the residential sector, the majority of which (57.9%) were new constructions.

When asked what the main concerns are, the top two were regarding time and satisfaction with the end product. This provides AQ with the incentive to provide an effective and clear way of communicating, to save time, and ensure that both parties are on the same page throughout the whole process.

Furthermore, six people stated that money is another concern for them when it comes to finding an architect. Budget compliance is therefore another essential component for a successful collaboration between architect and client.

Only three people said they are worried about the project’s compliance with rules and regulations.

Based on the results of this survey, AQ should focus on minimizing the concerns regarding time and satisfaction with the end product through clear communication from the very start of the process – this is the best way to ensure customer satisfaction.

The survey also looked at the relationship between final satisfaction with the project and the organization of project management. This gives AQ an idea of what may influence the customers’ satisfaction with the project.

The results show that there does not seem to be a significant relationship between final project satisfaction and whether a customer takes over the project management himself or has the architect responsible for it.

Given a scale from 1 to 10, with 10 being the best, each of the respondents who had prior experience with architects stated a final satisfaction between 5 and 7, regardless of their project management organization.

Though there cannot be said to be a strong correlation between management organisation and final satisfaction, there seems to be a just slight tendency for there to be higher satisfaction when an architect has taken over responsibility.

The diagram above attempts to illustrate the impact of budget compliance on customer satisfaction. This helps deduce the extent to which AQ should be worried about the correctness of the cost estimates given to the client at the beginning of the process.

While 33.3% of the respondents whose budget was met were very satisfied with their project, only 20.8% of those whose budget was exceeded felt the same. A trend can, therefore, be seen that customers are more satisfied with their architect if the budget is adhered to.

The questionnaire also contained open questions, which will be evaluated in the following section. These help to provide AQ with an insight into what the interviewees found to be particularly challenging when working with an architect, and at the same time provide a guideline for improving their own service.

2.1.1 Problems finding an architect

Whereas 24% of the respondents stated that they didn’t come across any problems finding an architect, 20% perceived the enormous number of architects and the resulting time-consuming selection process as a major problem.

This 20% is illustrative of the latent demand for a service like AQ, which encapsulates exactly this process of simplification in the search for architects and to assist potential customers in obtaining information during their search phase.

One respondent mentioned the lack of information about architects’ expertise and recent projects as a big issue when finding a suitable architect.

In order to ensure that customers have a precise idea of the architects’ previous projects, AQ should not only provide collected information such as pictures of previous projects but also, if possible, summaries the core competences of each architectural firm in a profile that can be accessed easily by the potential customer.

Another interviewee stated that trust problems make the search for an architect difficult. In order to counteract this and to ensure problem-free communication between client and architect from the very beginning, AQ should list the architects in

such a way that the contact details are easily accessible. This will enable acquaintances to be made much more swiftly between both parties and to lay the foundation for a trusting cooperation.

2.1.2 Advice to themselves

When asked what advice the respondents would give to themselves if they were working together with an architect again, 24% answered to get as many estimates as possible and compare the results to find the most suitable architect.

This shows, once again, the latent need for companies like AQ, which greatly simplifies the process of obtaining quotes.

Three respondents stated that a trustful relationship with the architect is essential for a good end result and a pleasant collaboration. AQ must, therefore, focus on creating this atmosphere of trust. This is mainly ensured by good and up-to-date communication.

The importance of trouble-free communication for clients is shown by the fact that three of the respondents mentioned communication in particular.

For them, this means that the architects are not only easily reachable, but also that the customers are always kept up-to-date on the state of affairs.

What is seen as important is having an overview of the steps that have been completed, in addition to being included in the remaining steps, in order to be able to intervene promptly in the event of discrepancies.

This also fits in with the answer of another interviewee, who would recommend to always keep detailed minutes for meetings with the architect.

Two of the respondents argued that it is important to have a distinct idea of the project from the very beginning in order to provide the architect with as many guidelines as possible in order to avoid later discrepancies.

One way to do this would be to have a very detailed questionnaire that potential clients have to fill out at the beginning of the

collaboration. These questions would have to go beyond the standard questions about budget, etc. and make the client think about what exactly they envision.

For clients who do not yet have a clear idea, however, it would be very important to refer to the architect’s personal contact at this point, so that a more precise idea of the final result can then be created together. Either way, it is essential that even the most detailed questions are clarified in advance.

For our final question, we asked our respondents if they would use a service like Architecture Quote. 29.17% of them stated that they wouldn’t want to use it, mainly because they would want to choose their next architect out of their own network, and don’t view the research process as too demanding.

But others looked at the platform as a big help for the process of finding an architect, claiming that it increases the pool of potential architects and offers a better overview of documents and profiles. In total, 70.83 % stated that they would in fact use such a platform.

Financially, it would cut out the middle man, while offering a tool for easy comparison and communication.

Another big selling point seems to be the accessibility of information, especially in situations of unusual hiring requests and/or special requests that are usually harder to research without the app’s help.

All in all, potential clients seem to realize the potential rise in effectiveness due to the bundling of portfolio expertise and contact information, whilst also appreciating the reduction of effort and time within the research and hiring

process.

Architecture companies interviews

We interviewed eleven architects from different companies in Denmark Germany, Austria, and Sweden. The architects were employees on different employment levels, ranging from general architect to project leader.

Most of the companies that we interviewed were small to medium-sized, with the exception of two large companies (with 75 and 120 employees). The average age of the companies we spoke to was around 15.5 years, with the exception of one family company that has been in business for 77 years.

Most companies have more than 10 clients and they are working on more than 10 projects at a time. One of the companies provided some inside information on some projects that are awaiting approvals from other parties.

It was discovered that six companies refuse at least two projects a year, with the most common reason being that the project is out of their range of expertise. The size of the projects differs from between 2.000 to 30.000 square meters.

The companies we spoke to get some of their new leads from tenders, but mostly referrals and through word-of-mouth. Only one company is working with a company that provides leads, and they are paying them an annual fee. Some architects think that paying for leads is not enough because, as one of the respondents put it , “it doesn’t work that way”.

A useful insight for AQ is the following questions, which the architects mentioned they usually ask the contractors:

- Who owns the property the building is being built on?

- What is the payment plan?

- What is the approval process (what permit is/has to be approved)?

- What are the main criteria?

Almost every company sees two big challenges, one being a general economic slow-down, and the other being not keeping up with technological advancements. Since the work has been up and down, there is an inconsistency of workflow, meaning companies must hire and fire the workforce continuously.

We can conclude that the companies we have interviewed get most of their projects through word-of-mouth. This can lead to the conclusion that the architecture industry heavily relies on trust, loyalty, and referrals, in addition to being a high-investment industry, involving extensive decision-making.

Denmark Conclusion

Research shows that Denmark is engaged in improving the already healthy and competitive landscape of the architectural market through the government’s ten target areas.

Political engagement is funneled towards major building projects, with the intention of attracting foreign players and innovation. The smaller residential construction industry tells another tale, with construction permits and starts all declining throughout recent years.

The environment is healthy, but the bids are in short supply.

Overall, the Danish architectural markets present high profits, political engagement, and a large ocean of potential customers with high buying-power compared to the number of residents.

Austria Conclusion

Research shows that Austria also has governmental intentions that affect the architectural market very positively.

Along with the federal guidelines, the process of acquiring building permits is very fast, while key housing-indicators have been inclining throughout recent years.

A great example is the construction output, in addition to building permits having increased with two-digit percentage-points between 2018 and 2019.

Overall, the value of the architecture market is relatively high compared to other European countries. However, it is important to note that over half of the projects are refurbishments.

In this regard, it is very important to state that individual houses account for 46% of the total client-base in the Austrian architectural market.

Germany Conclusion

Research shows that Germany is one of the biggest nations in terms of their architectural market-size. The housing index currently shows an all-time high and most projects are originated from individual houses.

With the home ownership rate increasing as well, data suggests a very healthy market, especially within smaller constructions, where the number of building permits per month is close to the record attained in December of 2016.

Consequently, the architecture market in Germany is highly mature, accounting for one of the highest construction outputs in the world.

The value and overall attractiveness of the architectural market in Germany is not a secret at all – in 2013 Germany had ten times the number of architects that Denmark had.

To put things in perspective, France has virtually the same construction output as Germany. Germany has three times the number of registered architects than in France.

This strengthens findings from prior research suggesting that the smaller/medium construction projects are especially thriving in Germany.

Overall, the German market is dominated by huge output, numerous competitors, and staggering, but stable, growth.

Switzerland Conclusion

The Swiss architecture market is in fine shape. The presence of well-established schools and good trade have made it a fine market for new firms to become competitive in.

The Swiss architecture market, although a small contributor, is a proportionally large player in the overall European market.

Residential construction is by far the largest sector in the Swiss market. This sector is predicted to carry on increasing in value in the future, the same trajectory being taken on in the construction market.

Both sectors can attribute this growth to the buoyant global economy. However, it is well worth noting that a global financial downturn could topple this growth in an instance.

When considering AQ’s position in this market, it is worth noting that there are two similar competitors in the current marketplace, although neither offer as direct services as AQ. However, because they do provide a similar product, they are therefore a direct competitor to AQ’s potential ranking in the market, especially given they are primarily Swiss-based companies.

Target market

We can conclude that Germany is the most appropriate market, with the overall highest potential for the business model of AQ.

The country of Germany displays a high selection of architects divided between over 300.000 building permits every year.

Architecture markets like Austria and Denmark are both mature, high profit-markets, with stable growth and great political conditions – but they do not present the same value of scale and size as the German architecture market.

Primary research conclusion

In the aftermath of concluding the macroeconomic analysis of the different countries, an assessment of behavior was carried out through primary research in the shape of interviews and questionnaires.

Primary research suggests that there is a correlation between having a full-time job and wanting to build a construction project. In other words, people with full-time jobs are the people who have financial opportunities to consider a construction project.

The data also suggests that the majority of respondents will look towards their network, friends, and family when trying to find an appropriate architect.

Primary research furthermore suggests that respondents are inclined to be partial to a project focused on residential construction – especially people who consider building in urban and suburban areas.

Overall, urban areas are the most appealing for the respondents who asserted a certain interest in the concept of AQ.

Projected data outlines that smaller projects – under 200m2 – are the most appealing to the respondents. This statement can be explained by the fact that most respondents are placed in urban areas, where there are naturally limits placed on amount of space.

In terms of concerns around a construction-project, money and time are the biggest concerns, as outlined by the respondents – especially within the residential area.

The data also presents “satisfaction with the end product” as a major concern for the projects to be carried out.

It is vital to mention that “time” is not the leading concern as this was mainly voiced by the respondents who want a construction project processed in the future. This suggests that recent years have contributed to a change in perception, whereby the time used is increasingly more important than the actual satisfaction with the end-product.

Out of the people who declared an interest in the concept of AQ, most of the respondents stated that an “easier process of finding the appropriate architect” is the main reason for the interest.

Out of the respondents who formerly worked with an architect, the majority stated that the number of architects and the time-consuming selection process is one of the major concerns.

Furthermore, a large percentage of those respondents declared that a comparison between numerous estimated bids could be a suitable solution to their problem.

Consequently, a striking 71 % of the total respondents stated that they would consider the use of a platform that would ease the process of an architectural project.

With this statement in mind, it becomes evident that the business model of AQ can potentially be a tool that can solve important problems for consumers and providers in the given market.

In other words, the respondents express a need for a streamlined process and that is exactly what AQ taps into.

0 Comments